Investor funds protection

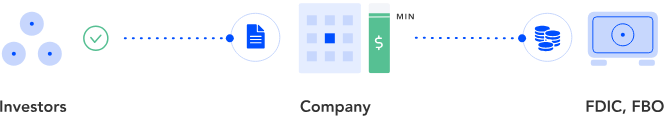

SEC mandates that funds raised during the campaign are held in escrow until the offering reaches its minimum target. Only after this target is met can funds be transferred to the issuer. Issuers must work with an SEC-registered escrow agent or a third-party escrow service provider with a FDIC-insured FBO account, ensuring an added layer of security and transparency.

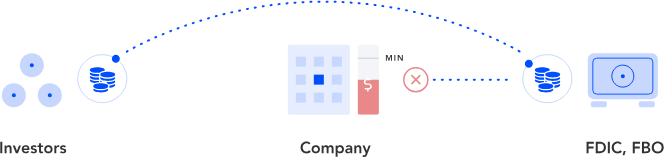

Upon reaching its minimum fundraising target, the investment company facilitated the transfer of capital from the third-party FDIC-insured FBO account to its own accounts. Subsequently, the company issued purchased securities to each of the investors.

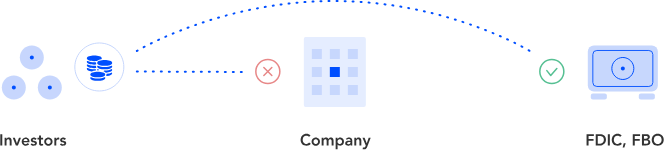

In the event that a company failed to reach its minimum fundraising goal, all commitments were promptly returned from the third-party FDIC account to the respective investors. The product was designed without any hidden fees or accrued interest.

Seamlessly integrating these services and ensuring timely fund release adds complexity to transaction handling.

Related pages

- FINRA Requirements for Broker-Dealers

- dealing with litigation risks

- educational support

- investor relations and transparency

- Managing Escrow Logistics

- Managing Investor Relations

- Non-accredited Investor

- Reg A+

- Resale Restrictions

- Regulations

- advertising and solicitation rules

- currency conversion and international payments

- filing and disclosure automation

- form 1-A

- global investor participation

- investment limits for non-accredited investors

- investor tracking and notifications

- market demand and pricing

- ongoing reporting

- real-time transaction processing

- regular audits and compliance

- Reg A

- regulatory reporting

- system uptime

- Campaigns conducation

- Disclosure of Risks

- Form C-AR

- Form C

- Investment Caps

- Liquidity for Investors

- Marketing and Advertising Restrictions

- Tax Reporting

- Verification of Eligibility

- Reg CF

- Financial Statements Audit

- Reg D

- Blue Sky Laws

- Form d

- Ongoing Reporting Obligations

- Proper Risk Disclosure

- Protecting Non-Accredited Investors

- Reg D 504

- Reg D 506 b

- Reg D 506(c)

- advanced valuation models

- complexity of alternative assets

- continuous oversight

- escrow and payment integration

- illiquid markets

- illiquidity of alternative assets

- lack of standardized valuation

- market-making challenges

- matching buyers and sellers

- multiple jurisdictional regulations

- operational complexity

- performance monitoring

- regulatory reporting requirements

- secondary market

- settlement time

- transaction reporting

- valuation of alternative assets